|

IN BRIEF

|

Getting rich may seem like a distant and complex goal, but it is entirely possible to achieve it by simplifying your approach. Imagine a five-easy-step process that will help you improve your financial situation without requiring constant effort. In this article, we will reveal practical and accessible strategies that will allow you to gradually establish healthy financial habits in your daily life. Get ready to discover how, with a little discipline and the right methods, you can grow your money while leading a fulfilling life.

Getting rich may seem like an unattainable dream for many, but with the right strategies and a little discipline, it can become a reality. This article walks you through five simple steps to achieve your financial goals without thinking too much. By following these tips, you can start saving, investing smartly, and seeing your finances thrive without extra effort.

Automate your finances

The first step to becoming rich is to automate your finances. Set up automatic transfers to your savings accounts or investing may seem simple, but it has a huge impact on your ability to accumulate wealth. When this money is transferred automatically, you don’t feel the need to spend it, and it starts growing on its own.

Set up automatic transfers

Insist on setting up automatic transfers from your current account to a savings account or investment account. The important thing is that these transfers take place without any intervention on your part. So, each month, a percentage of your income will automatically be set aside or invested, creating a habit of passive wealth.

Use financial management apps

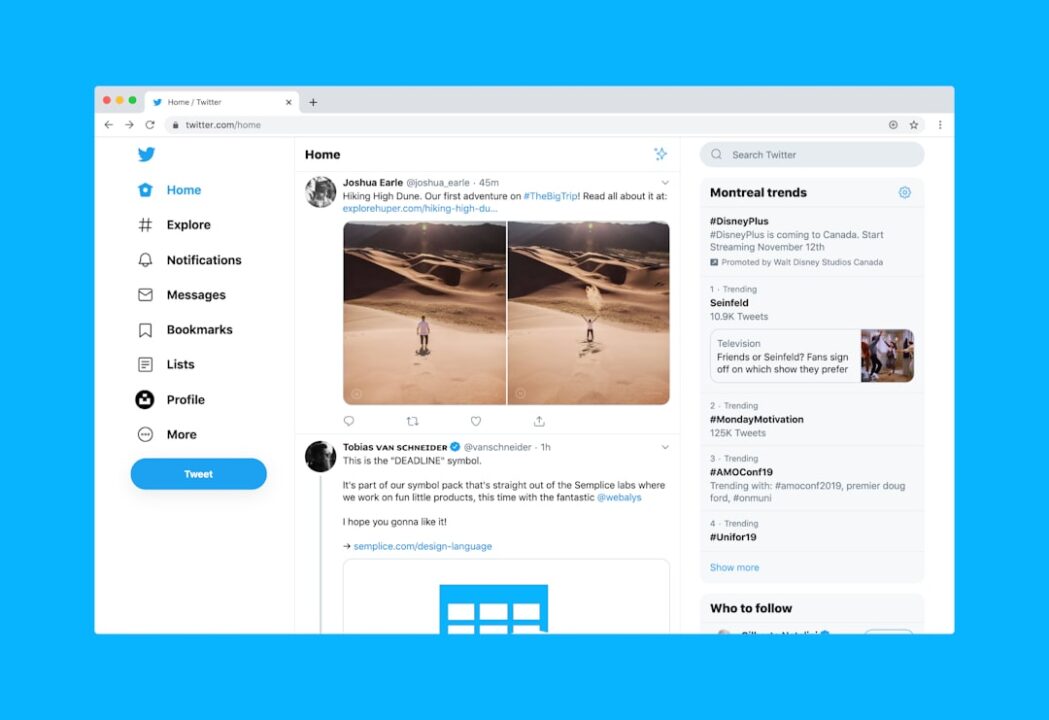

Financial management apps like YNAB or Mint can help you track your spending, set savings goals, and even analyze areas where you can cut back. These tools are essential for automating not only your savings, but also your spending, to maximize the funds you can set aside.

| Stage | Description |

| Secure your income | Have stable sources of income, diversify your activities. |

| Save automatically | Set up permanent transfers to a savings account. |

| Invest smartly | Use low-cost investment platforms. |

| Train gradually | Gain financial knowledge through books or online courses. |

| Avoid unnecessary expenses | Adopt a minimalist approach to reduce costs. |

-

1. Save Automatically

Set up an automatic transfer to a savings account.

-

2. Invest Passively

Use index funds or ETFs for effortless investing.

-

3. Continuously educate

Consume books and podcasts about money and investing.

-

4. Optimize Spending

Review your subscriptions and reduce unnecessary spending.

-

5. Diversify Income

Consider passive income sources like rentals or royalties.

Invest in safe financial instruments

Investing is one of the most important keys to accumulating wealth. However, it is essential to choose safe investments and avoid the pitfalls of overly risky investments. Here are some interesting options for investing safely and efficiently.

Investing in ETFs and Index Funds

Exchange-traded funds (ETFs) and index funds are popular investment options because they diversify your portfolio while minimizing risk. They track a specific market index and provide exposure to a wide range of stocks without you having to choose individual stocks yourself.

Life insurance

Life insurance is another safe and streamlined form of investment. In addition to providing financial security for your loved ones in the event of your death, some life insurance policies also offer cash value that you can use as a source of retirement income.

Create sources of passive income

Passive income is a great way to make money without spending a lot of time or effort. By generating passive income, you can increase your earnings while having more free time to focus on other aspects of your life.

Investing in rental real estate

Rental real estate is a well-established source of passive income. By purchasing properties and renting them out, you can generate a steady stream of income without significant time investments. Make sure you research the market carefully to maximize your returns.

Participate in affiliate programs

Affiliate programs allow you to earn commissions by promoting someone else’s products or services. This method is especially effective if you have a blog, YouTube channel, or strong social media presence.

Reduce and control your expenses

It’s essential to understand your expenses and find ways to reduce them. By controlling your spending habits, you can free up more resources to save and invest, improving your long-term financial situation.

Use the 30 day rule

The 30-day rule can help you avoid impulse purchases. When you want to buy something from Amazon or another site, wait 30 days. If after this period you still feel the urge to buy it, then do so. Otherwise, you have just saved a significant amount of money.

Optimize your subscriptions

Re-examine all your monthly subscriptions such as streaming services, magazine subscriptions or even gyms. Be honest about which ones you actually use and cancel the ones that no longer serve any purpose.

Learn new skills

Learning new skills can significantly increase your income potential. Always being learning and investing in yourself can lead to career opportunities that will pay you much more in the long run.

Invest in financial education

Knowledge is power, and that’s especially true when it comes to personal finance. Spend time reading books, listening to podcasts, or taking online courses focused on investing and money management. Consult works like those listed here for a solid foundation.

Multiply sources of income

Developing multiple incomes can include entrepreneurship, freelance work, or even asking for raises or promotions in your current job. Explore strategies that allow you to increase your earnings based on your talents and interests.

By integrating these strategies into your daily life, you position yourself for financial success. Whether you automate your finances, invest in safe financial instruments, create passive income streams, reduce your expenses, or learn new skills, each step brings you closer to your ultimate financial goal.

Frequently asked questions

A: The 5 steps include setting clear financial goals, creating a budget, investing wisely, eliminating debt, and continually improving your skills.

A: Setting financial goals helps you set direction, measure your progress, and stay motivated in the wealth creation process.

A: An effective budget is built by tracking your income and expenses, identifying essential categories and adjusting unnecessary expenses to save more.

A: Recommended investments for beginners include index funds, stocks of solid companies and rental real estate, which offer long-term growth potential.

A: To eliminate debts effectively, it is advisable to adopt the snowball method, which involves paying off the smallest debts first, or the avalanche method, focusing on those with lower rates. of highest interest.

A: Improving your skills is essential because it opens the door to new professional opportunities, increases income potential and allows you to adapt to market developments.